Early September steel price or will moderate rebound

2018-09-06

In the last week of August, the price of steel futures fell sharply, a panicked price slump. The market for several days of the rise in the results of almost all of the 3 day, the steel price returned to the end of July at the beginning of August level. Rebar and hot-rolled coils the lowest price and the highest price of the main contract decreased by more than 200 yuan per tonne in the previous week, showing that the overall price of steel futures fell sharply.

However, the hot-rolled sheet price than the rebar period price drop resistance relatively slightly larger, which prompted the price gap between the two continue to narrow. Last week (August 27 ~ 31st), rebar futures prices shake back sharply. Data show that as of 23:0 August 31, rebar main 1901 contract the latest price of 4104 yuan/ton, compared with the last trading day settlement price rose 8 yuan/ton, up 0.2%, lower than the same period in the previous week 212 Yuan/ton, Decreased by 4.91%, the highest and lowest prices were 4118 yuan/ton and 4080 yuan/ton respectively, down 223 yuan/ton and 230 yuan/ton, respectively, by 5.14% and 5.34% in the same period of the previous week, with a closing price of 4086 yuan/ton and a decrease of 45 yuan/ton compared with the last trading day. The drop was 1.09%, down 248 yuan/ton from the same period the previous week, reaching 5.72%. The latest prices for threaded steel 1810, 1809, 1811 and 1905 are 4389 yuan/ton, 4797 yuan/ton, 4340 yuan/ton and 3842 yuan/ton respectively, up from August 30 to 0.62%, 4.76%, 0.14% and 0.05% respectively.

Decreased by 1.83%, 7.36%, 2.45% and 6.06% per cent over the previous week.

Last week, hot-rolled sheet futures prices also opened the plunge, albeit slightly smaller, roughly the same as the rise. Data show that as of 23:0 August 31, Hot rolled coil main 1901 contract the latest price of 4092 yuan/ton, compared with the last trading day settlement price rose 1 yuan/ton, up 0.02%, lower than the same period in the previous week 175 yuan/ton, down 4.1%; the highest price is 4094 yuan/ton, Decreased by 209 yuan/ton, down 4.86% from the same period the previous week, and the lowest price was 4051 yuan/ton, down 211 yuan/ton compared with the same period the previous week, down 4.95%.

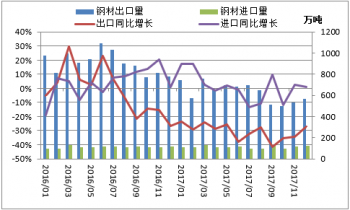

Hot rolled coils The latest prices for 1810 contracts and 1905 contracts, respectively, were 4288 yuan/ton and 3866 yuan/ton, up 0.16% and 0.39% per cent respectively over the previous trading day, down 2.48% and 5.91% respectively over the same period a week earlier. "Boom" after the "slump", the price fall is actually a reasonable price return. In mid-August, the effect of the news about steel limited production was magnified, causing the market price to rise excessively, while the rising prices made the markets panic more intense. In the last week of August, the facts of the limited production were clear (the actual output was not substantially reduced as rumored), and everything began to return rationally. According to statistics, the Steel Association member enterprises in mid-August, the average daily output decreased by 2.16%, the national average daily output decreased by 1.74%; Steel Association member Enterprises Steel inventories increased by 3.32%. As of August 31, the National 29 key cities of construction steel Social inventory of the Zhouhuan ratio fell by 0.33%, but increased by 1.11% compared to the end of last month. Hot rolled coil social inventories are down 2.85%, but up 0.52% from the end of last month.

However, the price slump in recent days makes the market wait for the mood aggravating, the actual deal situation is not ideal. Although steel futures prices have fallen sharply, the spot price of steel is not very large. In the spot market, the market mentality is still relatively stable due to the low overall stock level of the steel.

For the current steel prices, short-term adjustment is not in place, the continued volatility is unavoidable, although it may rebound after the fall, but the magnitude will not be very large. Last week, steel futures prices were "plunged" after 3rd, and the pre-existing pullback pressure had been released a lot. Fortunately, the macro environment and resource supply and demand have not changed significantly, steel price slump is bound to be unsustainable. It is worth noting that, while the likelihood of a recent slump is small, the pressure to fall back is still there. For now, steel futures are extremely volatile and need to go through a tough "tug of battle" to find new Balance points. The author predicts that steel futures prices may pick up after a modest adjustment in early September.

Previous Page:In September, the steel market was first suppressed and then raised.

Next Page:Steel Price Might Continue To Moderate Rebound In The Middle Of September

CONTACT US

We're always working to expand the boundaries of what's possible. Stay up-to-date with the latest news, announcements and stories from SINO STEEL.

PRODUCT INQUIRY

Give us a few details about yourself and the demand requirements of products, we will reply you as soon as possible.