Steel Price Might Continue To Moderate Rebound In The Middle Of September

2018-09-18

Last week (September 3 ~ 7th), steel futures prices after the adjustment, the overall moderate rebound. The results of the previous consecutive days of rising after the 3rd "plunge" began to slowly adjust and restore. Steel futures main contract price rose to 4200 yuan/ton near.

Relatively speaking, rebar futures price recovery momentum is relatively strong, hot rolled sheet futures price recovery of about half of the strength of the thread steel, which makes the main contract of the ton of material price difference has been pulled to nearly hundred yuan. A few days ago last week, rebar futures price slight fluctuation adjustment, last Thursday night prices rose sharply, last Friday reached the peak, the price of high volatility run. Data show that as of 23:0 September 7, rebar main 1901 contract the latest price of 4240 yuan/ton, compared with the last trading day settlement price increased 30 yuan/ton, up 0.71%, higher than the same period in the previous week 136 Yuan/ton, up 3.31%; the highest price and the lowest price are 4244 yuan respectively Tons and 4184 yuan/ton, increased by 126 yuan/ton and 104 yuan/ton respectively compared to the same period in the previous week, respectively, Rose 3.06% and 2.55%; the afternoon closing price was 4186 yuan/ton, up 100 yuan/ton in the same period of the previous week, up 2.45%, the highest price has risen to 4253 yuan/ton.

The latest prices for threaded steel 1810, 1811, 1904 and 1905 were 4498 Yuan/ton, 4480 yuan/ton, 3985 yuan/ton and 3917 yuan/ton, respectively, up 0.72%, 0.86%, 0.53% and 0.77% from the September 6 settlement price. A few days ago last week, hot-rolled coil futures prices adjusted slightly, to a sudden sharp rise in the night of Thursday, a sharp decline in Friday morning after the peak, the price rebounded slightly at the close. Data show that as of 23:0 September 7, Hot rolled coil main 1901 contracts the latest price of 4148 yuan/ton, compared with the last trading day settlement price decreased 28

yuan/ton, down 0.67%, compared with the same period in the previous week increased 56 yuan/ton, up 1.37%; the highest and lowest prices are 4154 yuan/ Tons and 4110 yuan/ton, increased by 60 yuan/ton and 59 Yuan/ton respectively in the same period the previous week, Rose 1.47% and 1.46% respectively, the closing price of the afternoon was 4114 yuan/ton, up 50 yuan/ton in the same period of the previous week, Rose 1.23%, the highest prices had rebounded to 4234 yuan/ton.

Hot rolled coils The latest prices for 1810 contracts and 1905 contracts were 4319 yuan/ton and 3899 yuan/ton respectively, down 0.35% and 0.2% respectively from the September 6 settlement price. There must be a "fix" after the "plunge". In fact, in the last week of August, steel prices fell fast not only because of the limited production effect of steel, but also because the price of steel had risen too much and too quickly in the early days. Similarly, the moderate rebound in steel futures prices last week is actually a reasonable price fix. From the actual transaction situation, the lower price is smooth, and the higher price of the closing resistance significantly increased. It should be seen that this round of steel price rise period has lasted more than two years, the early stage of the low-lying gap has been filled, there are technical callback demand.

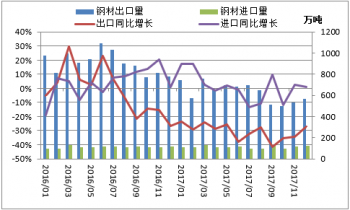

At the same time, the supply of steel resources is still growing rapidly, making the contradiction between supply and demand more and more intensified. The influence of local environmental limited production policy on steel market has both advantages and disadvantages. On the one hand, the market rumor that some areas require differentiated limited production, strictly prohibit fits, the industry pollution emission performance level is obviously better than other enterprises in the same industry environmental benchmarking Enterprises can not limited production. This could exacerbate supply and demand

contradictions and curb the rise in steel prices. On the other hand, some regions stressed that steel enterprises in September limited production ratio of not less than August, the clear request August stop limited production steel mills September shall not be allowed to resume production, August did not complete the task of the district September increased stop limited production strength, and the unauthorized re-production of steel mills have been named criticism.

This will be conducive to the stability of supply and demand relations, prompting steel prices rise. From the inventory situation, the current steel rebar and hot-rolled coil, such as the actual stock of the physical inventory slightly upward trend.

According to the monitoring data of the Steel Research Institute, as of September 7, the social stock of 29 key cities in China increased by 0.99%, and the total stock volume of hot rolled coils increased by 0.5% in the week. Nevertheless, because the steel spot inventory level is actually not high, the industry to the late demand is still optimistic, the overall market mentality is relatively stable, the price will be stronger. The current situation is that the momentum of price increases and the pressure of falling prices, steel prices continued volatility adjustment is inevitable. However, because the macro environment and the supply and demand of resources have not changed significantly, steel prices soared, the plunge will not be sustainable. Therefore, in the domestic steel market overall to a good trend, I expect steel futures prices in mid-September, after a modest adjustment may continue to rebound.

Previous Page:Early September steel price or will moderate rebound

Next Page:Recent Steel Price Or Continuous Fluctuation Adjustment

CONTACT US

We're always working to expand the boundaries of what's possible. Stay up-to-date with the latest news, announcements and stories from SINO STEEL.

PRODUCT INQUIRY

Give us a few details about yourself and the demand requirements of products, we will reply you as soon as possible.